dependent care fsa eligible expenses

The IRS determines which expenses are eligible for reimbursement. The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan yearTo qualify for this relief you must have been enrolled on or before January 31 2020 and you must have unused amounts from the 2020.

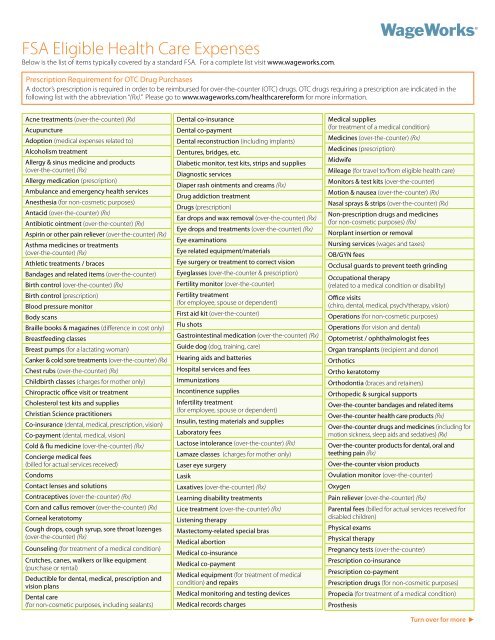

You can view a comprehensive list of eligible expenses by logging into your WageWorks account.

. FSA DCAP The SEBB FSA DCAP plans help you save money on your out-of-pocket health and dependent day care costs. The expenses must enable you and your spouse to work or look for a. This is why leveraging Dependent Care FSA funds to cover dependent care expenses is critical.

Below are the basic rules followed by our interpretation as they relate to standard service providers. Welcome to Navia Benefits WA State school employees in the SEBB Program. Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parents can work look for work or attend school full-time.

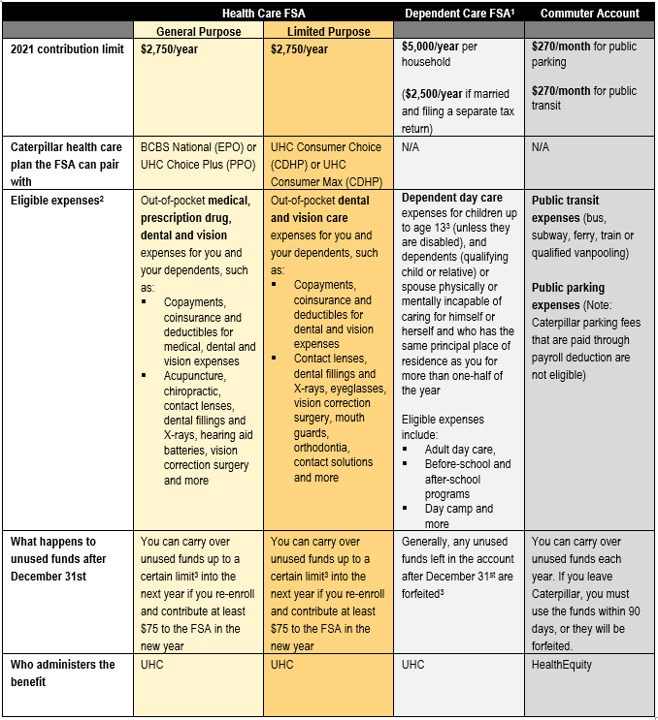

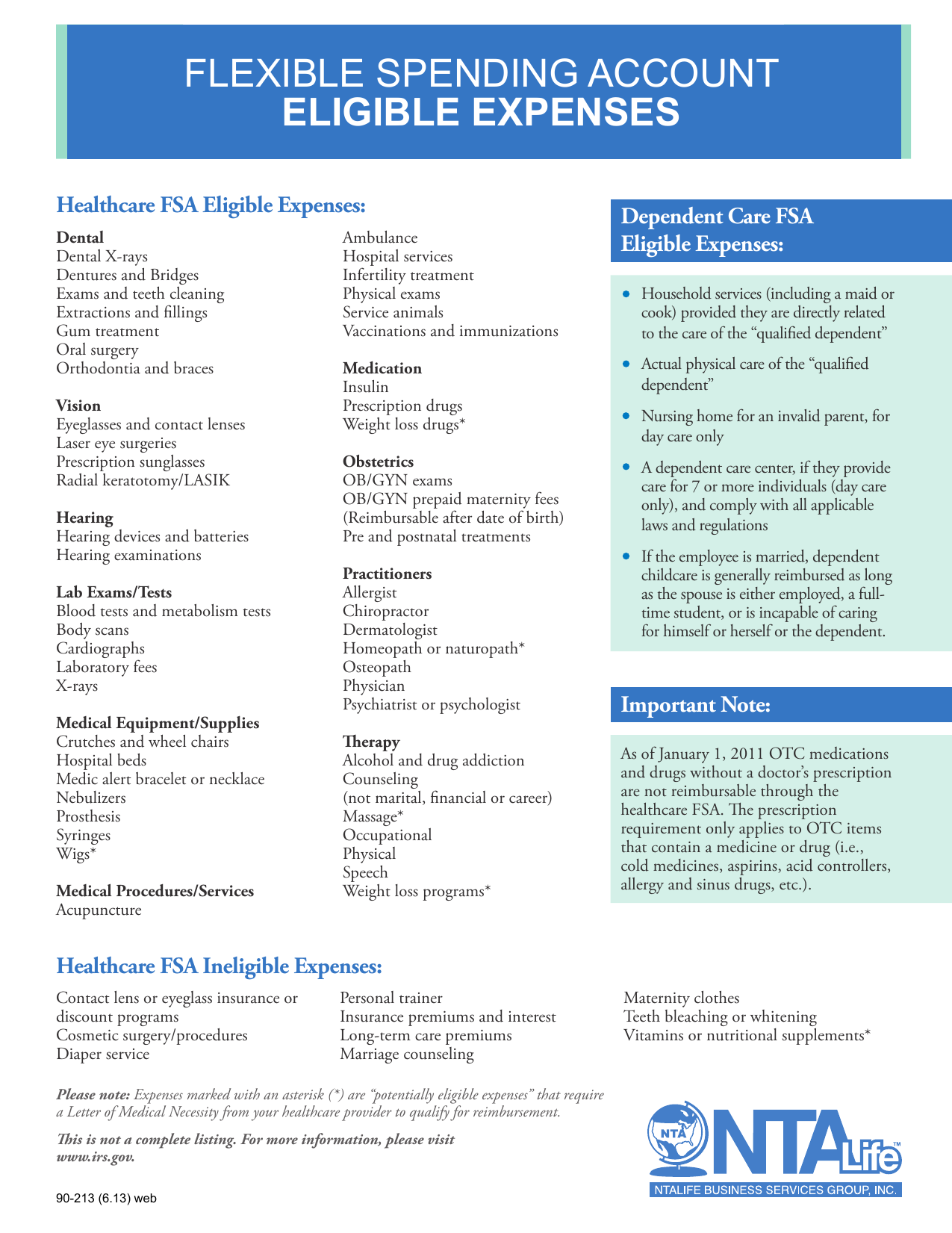

Is a Theragun and Other Massage Guns an HSA- or FSA-Eligible Item. If you are working you are able to use your account to pay for the care of your child under the age of 13 or to care for qualifying dependent adults. You can use your Limited-Purpose FSA to pay for a variety of dental and vision care products and services for you your spouse and your dependents.

The Savings Power of This FSA. In other words you and your spouse may not each claim 5000. What Weight-Loss Items Are HSA- or FSA-Eligible.

Dependent care expenses are not eligible medical expenses but may be eligible for reimbursement from a Dependent Care Account. The IRS determines which expenses can be reimbursed by an FSA. Written by Timalyn Bowens EA.

However employees with HSAs are only able to enroll in a Child Elderly Care FSA. Adoption fees associated with and medical expenses for adopted child The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA limited-purpose flexible spending account LPFSA or dependent care flexible spending account. Not Eligible for reimbursement.

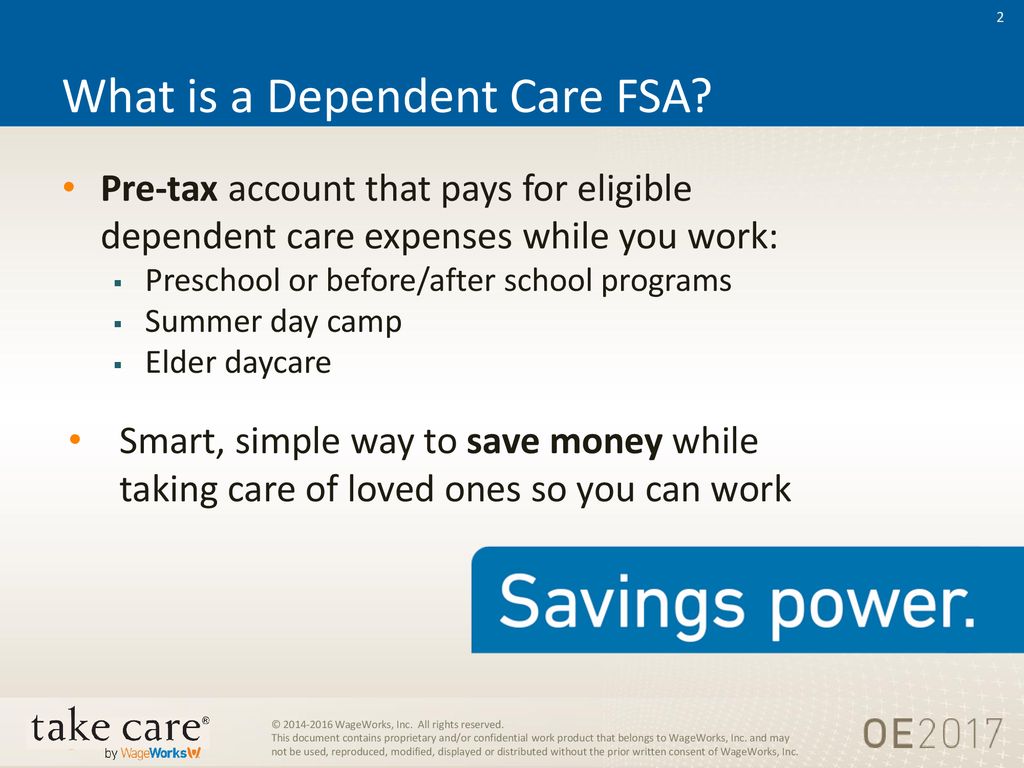

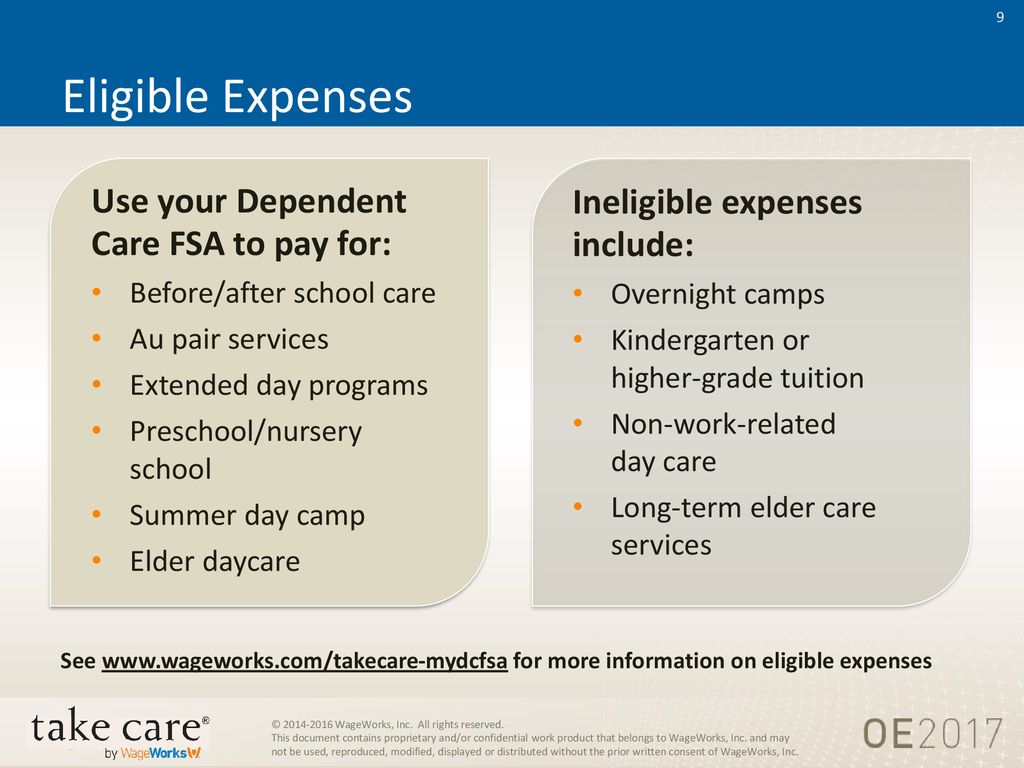

Dependent Care FSA Eligible Expenses. The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundableup to 4000 for one qualifying person and 8000 for two or more qualifying persons only for the tax year 2021 This means an eligible taxpayer can receive this credit even if they owe no federal income tax. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycareIts a smart simple way to save money while taking care of your loved ones so that you can continue to work.

According to the IRS. While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. Transportation to and from eligible care provided by your care provider.

Please note you may not double-dip expenses eg expenses reimbursed under your Dependent Care FSA may not be reimbursed under your spouses Dependent Care FSA and vice versa. The DepCare FSA allows you to pay for eligible expenses for care of your child generally up to age 13 or eligible adult dependent. Registration fees required for eligible care after actual services are received Sick-child care center.

You can set aside pre-tax dollars to pay for your qualified expenses and save between 25 and 40 on each dollar. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. HSA Health FSA and HRA Eligible Expenses ConnectYourCare 2021-12-22T101136-0500 There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance.

This applies even if the camp specializes in sports ie basketball volleyball etc or computers. 5000 per plan year 2500 if you are married and filing a separate income tax return. You determine how much you want taken from your monthly paychecks from a minimum of 180 per plan year up to the lesser of.

A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related out-of-pocket expenses for you your. A health FSA that reimburses all qualified section 213 d medical expenses without other restrictions is a. However you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021.

With a dependent care FSA you can save for day care childcare nursery school and preschool tax-free. Preschoolnursery school for pre-kindergarten. According to the IRS.

Dependent Care FSA accounts also known as Dependent Care Assistance Program DCAP accounts provide a tax-free way to cover day care related expenses for children under 13 as well as adult dependents. Dependent Care Flexible Spending Account eligible expenses are more expansive than many parents realize and narrower than others hope. How Does a Dependent Care FSA Work.

The maximum amount available if you are married but filing separate returns is 2500. Payroll taxes related to eligible care. Eligibility of 54 Common Eye Care Items Written by Charlene Rhinehart CPA.

Limited-Purpose FSA Eligible Expenses. Includes Blood-sugar test kits and test strips. Can You Use an HSA and FSA for Vision Expenses.

Written by Timalyn Bowens EA. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000.

Fsa Eligible Health Care Expenses

What Is A Dependent Care Fsa Tl Dr Accounting

Flexible Spending Account Eligible Expenses

How To File A Dependent Care Fsa Claim 24hourflex

What Is A Dependent Care Fsa Wex Inc

Your Flexible Spending Account Fsa Guide

Flexible Spending Accounts Smart Simple Savings Getting Started Is Easy

Dependent Care Fsa Flexible Spending Account Ppt Download

Navia Benefits Health Care Fsa

Erika Seaborn M A On Instagram Hsa Vs Fsa Smart Money Health Plan Independent Insurance

Health Care And Dependent Care Fsas Infographic Optum Financial

Pin By Angela Im On Activities Childcare Medical Activities

Health Insurance 101 Hsa Fsa Hra

Seasonal Expenses To Expect Around The Year Seasons Summer Childcare Expectations

Dependent Care Fsa Flexible Spending Account Ppt Download

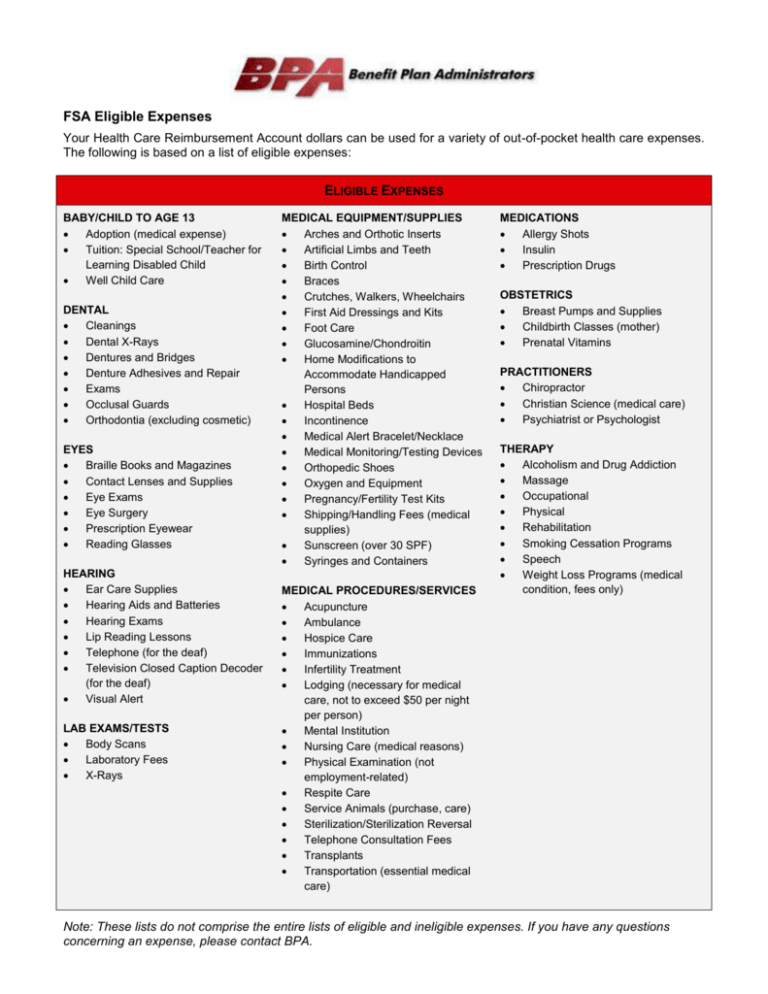

Fsa Eligible Expenses Your Health Care Reimbursement Account